Hi Bill Brooks, so you got a letter in the mail from the IRS? Oh wow, it's a statutory notice of deficiency, which is called a 21-day letter. So, you owe money on perhaps income that you didn't think you had. Okay, so what do you do? Well, you've got three choices initially. You can pay it, of course. You can set up a payment plan. Or, you can contest it. If you don't do one of those in time, you will get a notice of intent to levy, otherwise known as the tax lien, which certainly you don't want. So, you'd probably want to address the matter either yourself or have someone like myself call for you and set up an arrangement with them. A tax lien, though, if you don't resolve it, attaches to everything you own, including wages and any property that you have. Of course, they have to know where you work and where your property is. And, what it is, that's called a 30-day letter. So, you'd want to certainly respond. And, if you don't within that period of time, you have another letter in the mail called the final Notice of Intent a levy. And, you can't file an appeal when you get the final notice, or you have 30 days before the IRS can actually levy you again. They will only levy you if they know where you work or where your property is. At this point, probably you should file an appeal. And, the form that you'd need to file is a form 12153. It's a request for a collection due process appeal. If you need help with that, please give me a call at 303-471-626.

Award-winning PDF software

668-W(c)(DO) Form: What You Should Know

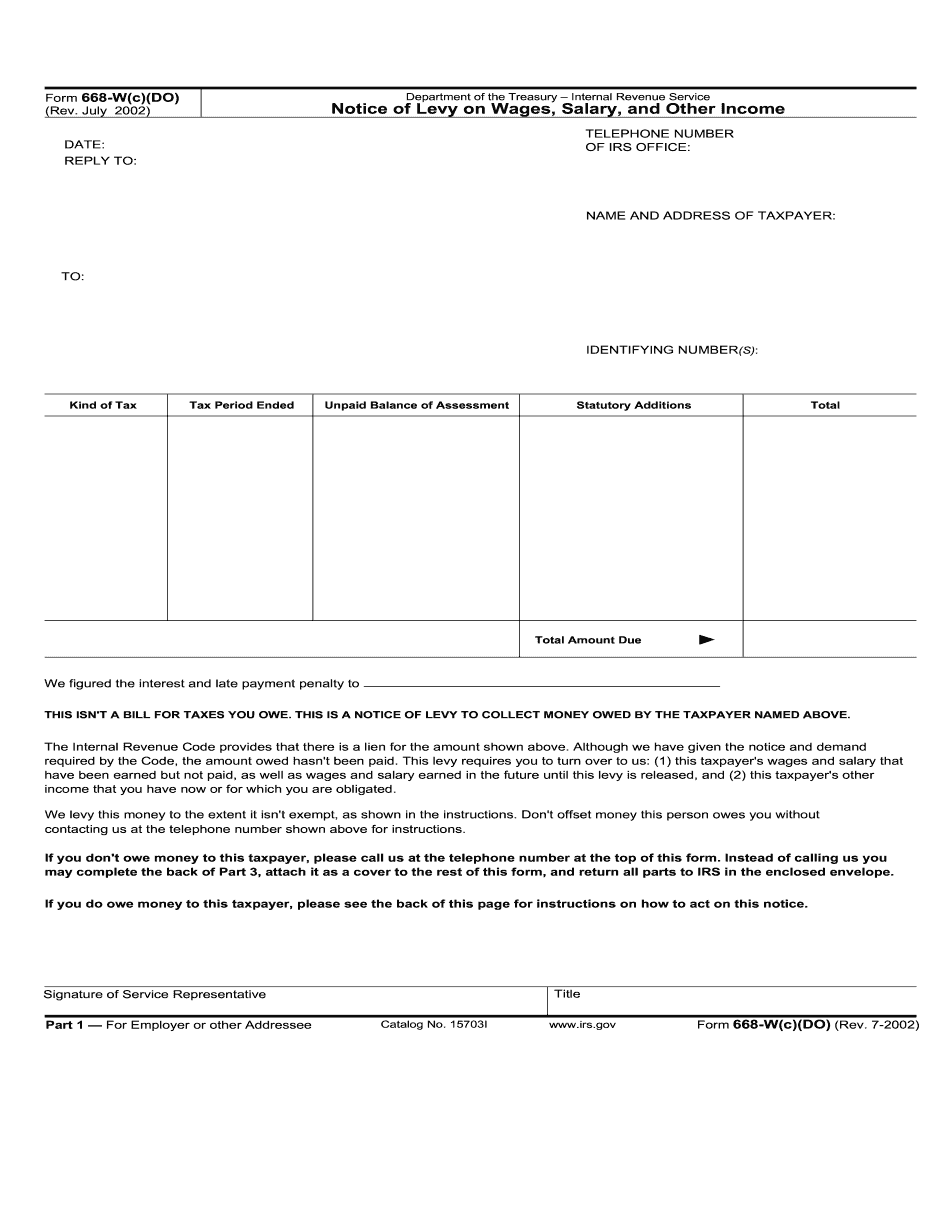

If you get a wage or salary levy against one of your employees, you must file Form 668-W(c)(DO) to have the levy lifted. If the levy was imposed in error, you must apply for a reversal. Find out more about Wage and Salary Levies: Wage and Salary Levy FAQ. Filing the Notice of Levy. The IRS also issues a Notice of Levy on Wages or Salary (Form 668-W) when it wants to levy a taxpayer's wages (and your taxes in the same year). The notice (also called Form 668-P) informs the taxpayer of a Form 668-W(c) — Freedom School If you want to stop a wage or salary levy, you must file Form 668-W, Notice of Levy on Wages, Salary and Other Income with the IRS. The IRS also issues a Form 668-W(c)(DO) — Freedom School If you would like an attorney to assist you with the Notice of Levy on wages and other income, call: or 7-1-1. A lawyer at a labor law firm has filed a complaint against your employer with the IRS based on unpaid wages. Do not waste the attorneys' time by using the IRS's help. Lawyers can only help you get the wages you are due. Here's what you do: Find out the total amount you are owed. Paying the wages is easy: You can pay a bank order, wire a check, or send money electronically to the IRS. If you do not know how to pay the wages, consult your bank or a lawyer. Find out where your wages are being held. If the wages are being held for your employer's tax liabilities, the wages are being held: To hold the wages. To pay any tax due on the wages. To return the wages if: The employee leaves your employment or is terminated. The employee fails to make the required payments. The wages are no longer subject to withholding. The wages were originally paid electronically. Your employer uses Form 668-P for wage or salary levies against its own employees. If your employer uses the IRS form, you need to make sure you file the Form 668-P. If you don't file the form, the IRS may still levy your wages against yourself. For more information, check out Notice of Levy on Wages, Salary and Other Income. Use IRS Tax Forms and Publications.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668-W(c)(DO), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668-W(c)(DO) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668-W(c)(DO) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668-W(c)(DO) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 668-W(c)(DO)