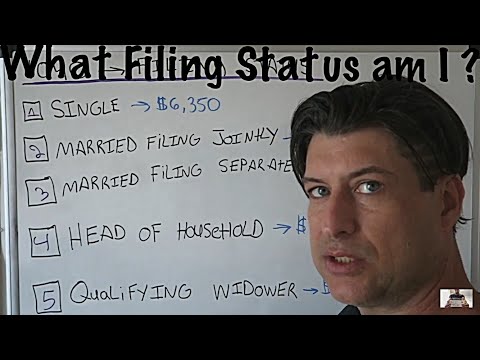

Yo yo yo, CPA strength here, back with another video. How could you guess? 'Cause you're watching a new video. Anyways, please subscribe to the channel for daily videos. I keep it going and we keep it alive. Yes, this is what we're gonna take Timmy up in. Anyways, please subscribe for daily videos. They're tremendous and you're gonna love every one of them, I guarantee it. Also, if you subscribe, I'll give you a cookie. If you're vegan, it will be vegan. If you don't want gluten, it'll be gluten-free. However you want your cookie, if you subscribe. Also, if you like this video right now, you gotta like it right now. You'll have good luck for the rest of your life. What is this video gonna be about? This is about filing status on a 1040 tax return. Let's get to the basics. There are five filing statuses. That's it. When you do a 1040 tax return, there are gonna be five. Oh, I am a licensed CPA in the state of Florida. I'm the strongest CPA in the state of Florida, but I'm a licensed CPA in the state of Florida. I've done well over a thousand different tax returns in the last seven years, going into my seventh season as a tax preparer. Currently, and I think this would be helpful, there are also questions I've gotten from clients below. Let's get into it. So there are five filing statuses. That's it. If you file a 1040 tax return, your filing status is either gonna be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Now, that's it. There's only five. So it's pretty cool. I guess you have a 20% chance of being correct. Now, let's just look. This is going...

Award-winning PDF software

Statement of dependents and filing status Form: What You Should Know

We are working on a form for the Form 1099-G you will need to write to the IRS with the income and deduction in the year you file, and we're looking into other options as well. 2022 WEBB Declaration of Tax Status. IMPORTANT: If you have more than one Ohio-resident taxpayer and the second taxpayer has a state tax return they file with the IRS that is not on the tax return you filed, that Ohio taxpayer does not owe any income tax until they file their state tax return for the tax year in which they do not have income. This includes you if you file for the same tax year you had income. These persons will be allowed to claim the non-resident state tax credit for other Ohio residents who file a tax return with the federal government, such as filing Form 8379. These persons do not owe income tax and if you do not list them on your tax return you will have to add them later to your income tax return. The federal and state income tax will not apply if you are exempt on your Ohio return, but the Ohio tax will need to be paid to the IRS. It is important that you send the proper tax forms to the appropriate tax office. Instructions for Form IT-204. Ohio Residency Form (and Instructions). 2024 WEBB Declaration. IMPORTANT: All Ohio residents must include their Ohio State Driver's License Number (Ohio driver's license does not have a VIN), State Issued Identification Number (the state issued ID) and Social Security Number (SSN) when qualifying for the refund. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency. Instructions for Form IT-204. Ohio Residency.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668-W(c)(DO), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668-W(c)(DO) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668-W(c)(DO) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668-W(c)(DO) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Statement of dependents and filing status