Hello, my name is Robert, and I'm an attorney with TRP. We specialize in tax law and handle garnishments, offer and compromise, and other related matters. In this article, we will discuss how to stop an IRS wage garnishment, also known as releasing an IRS wage garnishment or wage levy. Although some people may refer to these terms differently, they all refer to the same thing. There are different ways to stop an IRS wage garnishment, depending on your financial situation and whether or not you qualify for an offer in compromise. If you qualify for an offer in compromise, it means that your income and expenses are close to zero at the end of each month, based on IRS financial standards. In some cases, this means that you have very little or no money left over at the end of the month. However, if you do not qualify for an offer in compromise, the options for stopping the garnishment may vary. Additionally, there are two other ways to potentially stop the garnishment that we would like to mention. One option is to request a Collection Due Process (CVP) hearing. The other option is to submit an offer in compromise, and sometimes the garnishment can be lifted while the offer is being processed. However, these methods may not always be the most efficient or quick ways to stop the garnishment. Now, let's discuss the most efficient ways that we have found to stop an IRS wage garnishment. First, if you owe less than fifty thousand dollars and do not qualify for an offer in compromise, you can simply request a fresh start payment plan. This can easily be done by contacting the IRS. Second, if you owe more than fifty thousand dollars and do not qualify for an offer in compromise, you can...

Award-winning PDF software

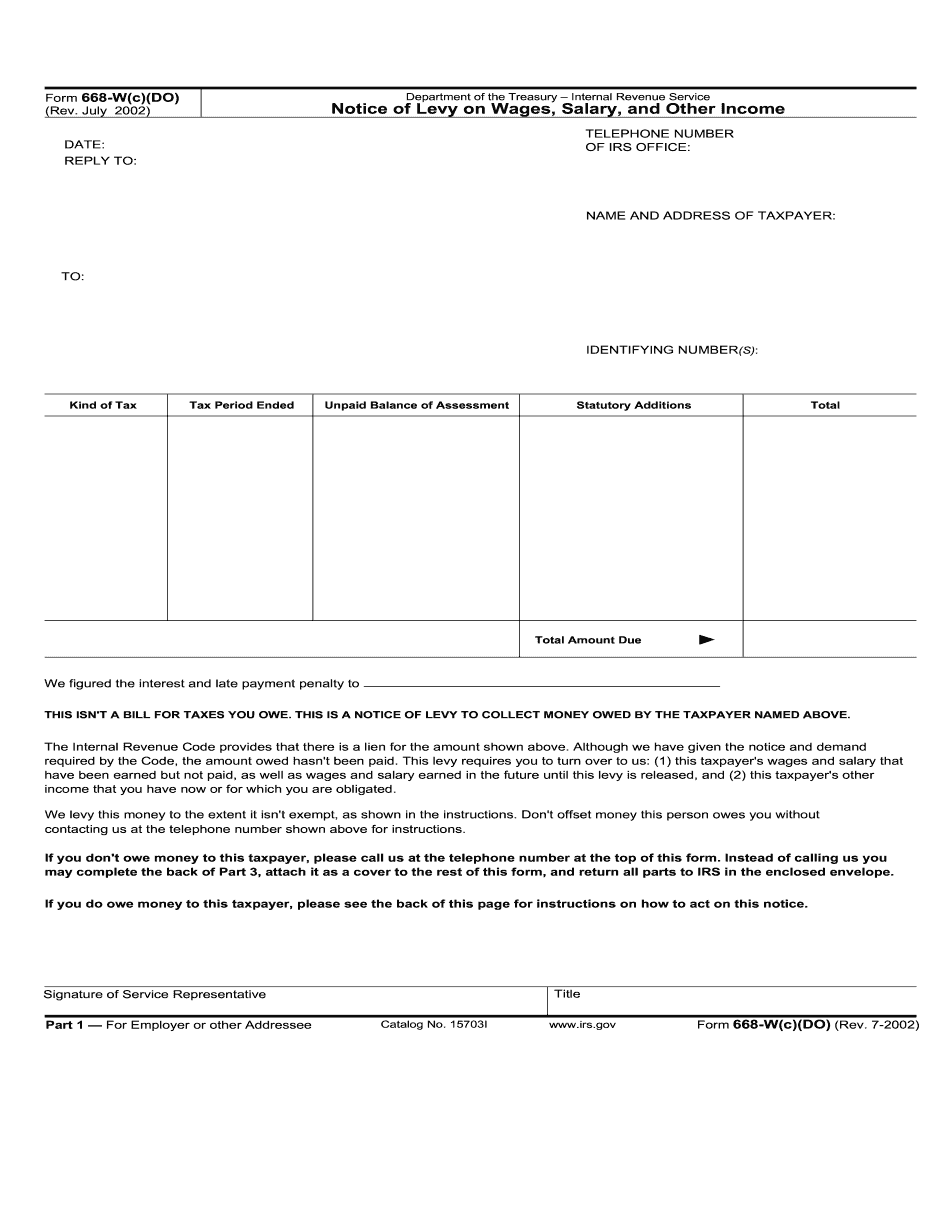

Irs Wage Levy calculation Form: What You Should Know

Read How to get a levy released in the case of a levy on wages or other earnings; Levy Release (Form 668-W) If the levy is based on the minimum amount of income, such as on a wage, see Publication 521, Minimum Tax, for information about the minimum exempt amount that will be levied. See Publication 521: Minimum Tax If the levy is based on a percentage of income, see Publication 15: Guide for Employers on The Minimum Tax for information about how to calculate your taxable income Information about levy release | Internal Revenue Service You must pay the levy if you owe the minimum amount of income tax. A portion of the amount collected may be refundable (reversible) for past-due taxes. If you make deposits or withdrawals of any money, you should not expect a levy to be released until the money is paid. If you are not allowed to open a bank account, you should not hope that a levy will be released by your financial institution. The money is considered cash, and will not be released until you pay the levy. If you had to use your account or pay deposits in the past to pay your taxes, and you expect to be allowed to keep your accounts closed, you should not expect a levy to be released until the money in them has been paid. See FAQs under How to get a levy released in the case of levy on wages. Get more information about withholding for wages and other earned income | Learn the penalties and interest if you do not pay your taxes or correct your errors, see Publication 534, Your Federal Income Tax for more information. Taxpayers eligible for a refund or an additional deduction who fail to file or correct income tax returns before the due date could be subject to a penalty of up to 5% of the tax liability, plus interest. See Penalty and Interest, later in this publication. You may have the right to an additional deduction or exemption. See Exemption, later. 5.11.6 Tax-Free Bonuses The following bonus is tax-free. If you take this type of compensation, you are also entitled to a refund or other tax credit based on your adjusted gross income. Learn more. Tax-free bonuses are not taxable.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668-W(c)(DO), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668-W(c)(DO) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668-W(c)(DO) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668-W(c)(DO) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Wage Levy calculation