The easiest way to publish a book on Kindle is to use a Word document. However, the Word document needs to be formatted correctly so that it is pleasurable to read and consistent throughout the book. So, let's start by formatting a Word document. Here's a sample book, and I've got some text and some chapters, but they're in different styles. You can see that this chapter heading is much bigger than this chapter, and we have an indented paragraph here, but here it's not indented. So, we want to make the book consistent. First, what we need to do is remove any styles that we don't need in the book. To do this, bring up your Styles drawer and let's have a look at the Invisibles. The normal styles, of course, are normal and heading one, and I have a couple of other styles here, centered and credits, but we're going to look for styles that are not necessary. For example, there's a style applied to a blank line that we don't need, so let's delete this style. Another unnecessary style here is normal.note.heading.selectable. Let's delete that too. We have the basic styles now. The next step is to look for blank lines that are separating the two paragraphs of text. An e-book needs to have floating text, which means the text will change in length and size depending on the device that the reader is using. So, we need to have the paragraphs joining each other and indented at the start. You need to go through the whole document and remove any of these blank lines. Looking good so far. The next step is to identify the chapters in the book. I don't want to remember all the names of the chapters, so let's put the word "Chapter"...

Award-winning PDF software

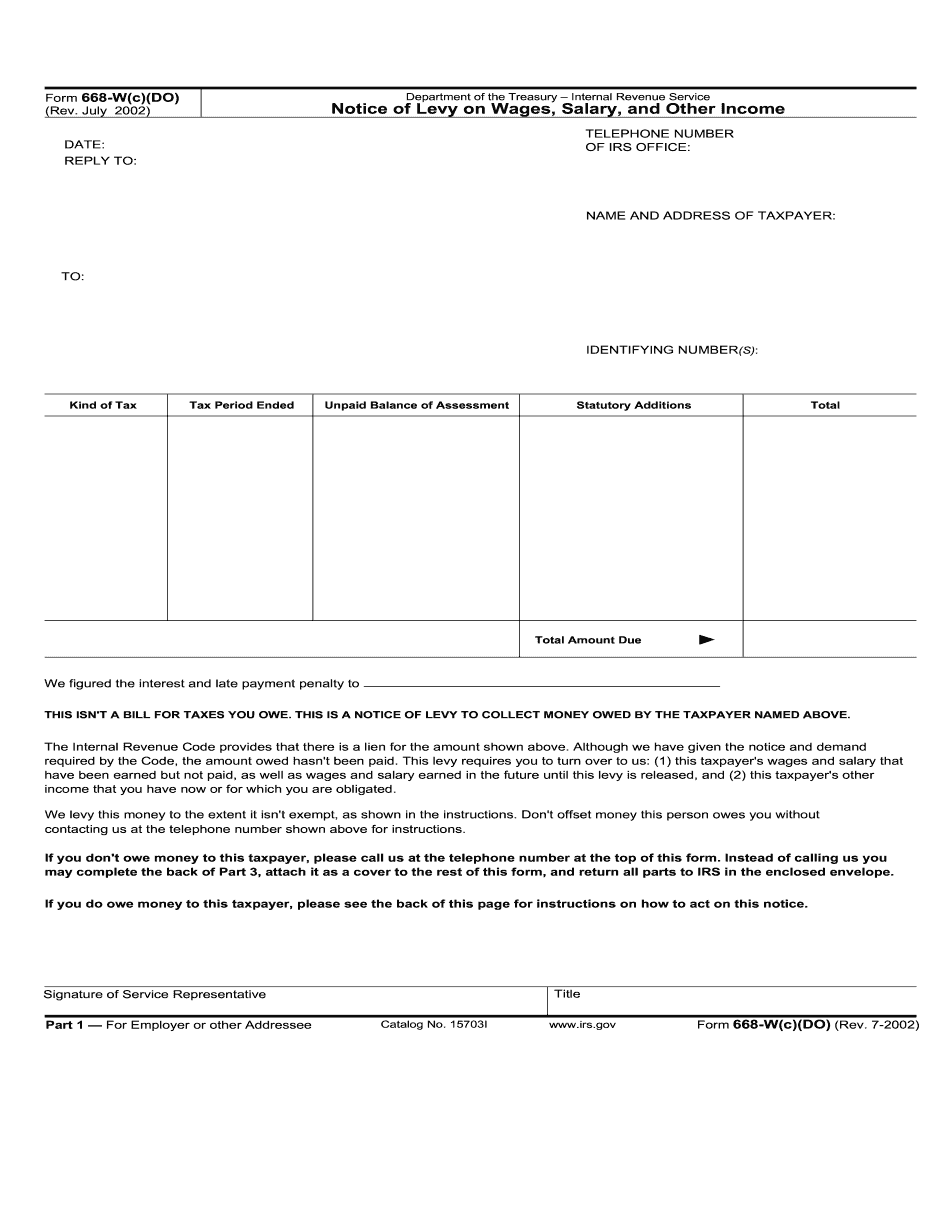

Irs publication 1494 2024 Form: What You Should Know

The following are some example cases where the IRS is seeking levy: · an individual who has income up to an annual limit on his or her salary, or up to a ceiling on other compensation for a specified business, or · the estate of a resident of the United States who has income for a specific purpose. Why? The IRS bases its estimates on a number of factors, including the dollar amount of income claimed by the taxpayer, the annual number of wages (plus base salary plus base bonus and other bonus amounts) and the annual gross earnings. How Do I Figure the Tax Due on My Wages? You're eligible to figure your tax due based on your gross wages if you meet all the following: · Have income, taxable wages and taxable bonus payments to estimate what you owe the IRS. · Are a U.S. citizen or resident alien. · Pay your taxes in full each year. · Report all income each year (including salary from outside the United States). If an IRS levy is assessed against your wages, you are responsible for the tax. If you do not have taxable wages or taxable bonus wages to calculate the tax due, you can estimate the taxable annual amount of your wages by adding the gross wages from all your taxable jobs, dividing the taxable wages by the number of weeks in the tax year and multiplying the quotient by 100. Note: These calculations are for you to use to figure tax in any situation you are eligible to use. Tax Due on Wages and Other Income by Worker's Nationality and U.S. Citizen or Resident Alien Income is taxable only to individuals who are U.S. citizens or resident aliens, as shown on the following tables: If you're an individual U.S. citizen or resident alien, the IRS will deduct all the income from your wages. If you're not a U.S. citizen or resident alien, you must figure your tax due on your wages to the extent that you: · Have not worked in the U.S. in the six months prior to your return, · Paid more than 5,250 during the tax reporting period for wages you received on more than one pay stub, but the amount exceeds 5,250, or · Work in the U.S. and report on Form W-2.2, Information for Employers.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668-W(c)(DO), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668-W(c)(DO) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668-W(c)(DO) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668-W(c)(DO) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs publication 1494 2024